back

backIn the financial industry, data security is one of the core elements of business survival and growth. With the acceleration of digital transformation, institutions such as banks, insurance companies, securities firms, and fintech enterprises face increasingly severe risks of data leakage. Sensitive customer information (e.g., personal identification data, bank account details, transaction records), core business data, and internal confidential documents—if compromised—can result in significant financial losses and privacy violations for customers, severely damage the enterprise’s reputation, cause customer attrition, and even lead to legal actions and hefty fines. Therefore, establishing an efficient and reliable Data Loss Prevention (DLP) system has become an urgent necessity for the financial sector.

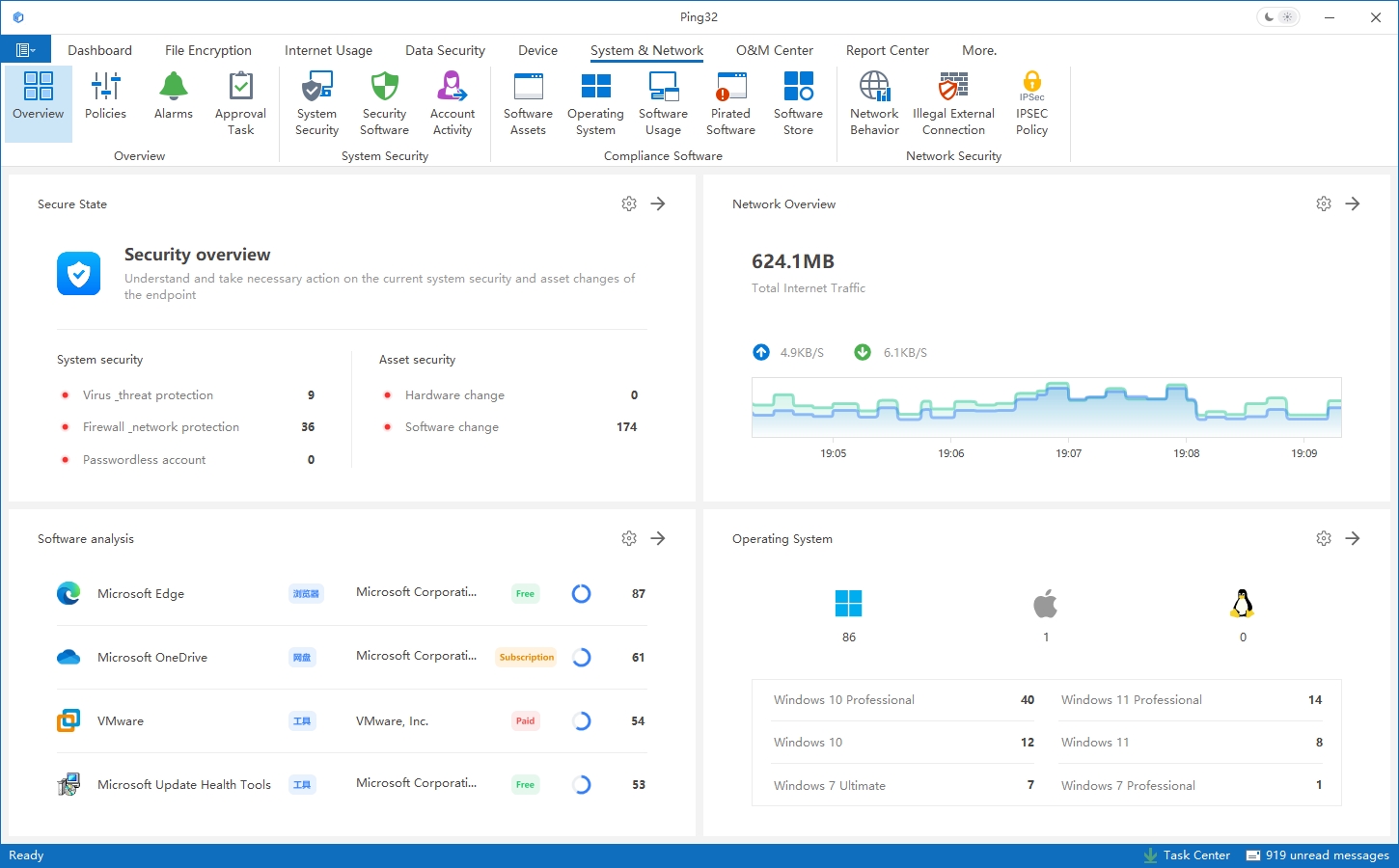

Ping32 Data Loss Prevention System is a professional data security product designed to help financial institutions meet regulatory compliance requirements and enhance their overall information protection capabilities in response to growing data security challenges.

1. Risk Analysis of Data Leakage in the Financial Industry

- Insider Misconduct: Internal staff may—whether due to negligence, malicious intent, or external incentives—illegally extract sensitive data via email, instant messaging, mobile storage devices, and other channels, leading to data leaks.

- External Cyberattacks: Hackers exploit network vulnerabilities or use malware to breach the information systems of financial institutions and steal sensitive data. For instance, phishing emails may trick employees into clicking malicious links that install trojans to extract data.

- Third-party Risk: During business collaborations with external partners, vulnerabilities in data sharing may lead to unauthorized use or leakage of data by third-party personnel.

- Mobile Workforce Security: With the rise of remote and mobile work, employees increasingly handle business data on personal or company-issued mobile devices. These devices are prone to loss or theft and are often used in less secure network environments, increasing the risk of data leakage during transmission and storage.

2. Ping32 Architecture for Data Loss Prevention in the Financial Sector

Ping32 offers a multi-layered, comprehensive data security framework, forming a complete protection lifecycle from data discovery and monitoring to prevention and auditing.

- Data Discovery and Classification

Ping32 scans various storage devices across the network—including servers, databases, and file servers—to automatically identify and locate sensitive data, such as customer personal details, transaction records, and financial reports.Based on the sensitivity and importance of the data, Ping32 classifies and grades discovered data. For example, ID numbers and bank account details are categorized as highly sensitive, while internal meeting notes and business plans are marked as moderately sensitive. This classification provides a foundation for developing tailored protection policies.

- Data Monitoring and Auditing

Continuous monitoring of data flows within the enterprise network, including internal transfers, access, and external transmissions. Abnormal operations—such as mass copying or unauthorized transmission of sensitive data—trigger immediate alerts.Comprehensive logging of user interactions with data, including timestamps, user identity, target data, and action types. These logs enable traceability and allow enterprises to identify potential security risks and violations.

- Data Protection Measures

A Ping32 DLP gateway at the network boundary performs deep inspection and analysis of outbound data. Sensitive content in emails, chat messages, or uploaded files is either blocked or encrypted based on preset rules. For example, emails containing ID numbers can be blocked, or files containing sensitive data can be encrypted before being allowed to leave the network.Ping32 client software installed on employees’ workstations protects sensitive data at the endpoint. It controls the use of removable storage devices like USB drives and portable hard disks to prevent unauthorized data transfers. Actions such as copying, pasting, and printing sensitive data are also restricted to prevent uncontrolled dissemination.Integration with commonly used business applications—such as core banking systems, online banking platforms, and CRM systems—enables data protection at the application layer. Access to sensitive data is governed by user roles and permissions, preventing unauthorized access and leaks.

- Encryption and Access Control

Advanced encryption algorithms protect sensitive data during storage and transmission. Even if data is intercepted or stolen, the attacker cannot decipher its content. Ping32 supports multiple encryption methods, including transparent encryption and full-disk encryption, customizable to enterprise needs.A robust user permission management framework assigns data access rights based on roles and responsibilities. Users are restricted to accessing only the data necessary for their job functions, preventing unauthorized access and misuse. Changes to access rights are strictly audited to ensure compliance.

3. Key Advantages of the Ping32 Solution

- Comprehensive Protection: Covers all aspects of financial data security—from discovery and monitoring to protection and auditing—forming a multi-layered defense system capable of mitigating a wide range of data leakage threats.

- Intelligent Recognition: Employs advanced data recognition technologies to accurately identify both structured (e.g., database records) and unstructured data (e.g., documents, images, audio). It also features intelligent learning capabilities to automatically refine recognition rules based on business characteristics and data trends.

- Flexible Policy Management: Enables enterprises to configure customized data protection policies based on their security needs and business workflows. Protection rules can consider data classification, user roles, time, and location, allowing for granular and precise data security management.

- Easy Deployment and Administration: Provides a user-friendly management interface for seamless deployment, configuration, and ongoing system management. Supports distributed deployments to accommodate complex network architectures and large-scale device management in financial enterprises.

- Regulatory Compliance Support: Helps financial institutions comply with national and industry data security regulations and standards such as GDPR, CCPA, and industry-specific regulatory mandates. Comprehensive audit logs and protection measures support enterprises in maintaining compliant operations.

Ping32 delivers a comprehensive, flexible, and efficient DLP solution tailored to the financial industry’s unique needs. Covering the full security lifecycle—from sensitive data identification and encryption to access control and auditing—Ping32 empowers financial institutions to manage data security with confidence. Its powerful features and proven success in real-world deployments establish it as a leading solution in financial data protection.

For more information or to request a trial of Ping32, please visit the official website.

Contact

Contact

7 min

7 min